Typical ebitda margin

Individual levers Mining operations. For example if the Price is 50 and the Earnings per Share is 5 the PE Ratio will be 50 5 10.

Ebitda Margins What Every Small Company Owner Needs To Know

Construction Services Industry Ebitda grew by 395 in 2 Q 2022 sequentially while Revenue increased by 1401 this led to improvement in Construction Services Industrys Ebitda Margin to 1576 a new Industry high.

. However the size of our real estate and asset-based lending borrowers varies greatly. The Definitive Voice of Entertainment News Subscribe for full access to The Hollywood Reporter. This reflects new recruitments over the period but also an overall increase in employee costs due to.

Pre-tax Pre-stock compensation Operating Margin. EBITDA is expected to be at least 15 million. Payroll costs increased by 122 to EUR401m.

While the decline in profitability is partly the result of even lower licence and maintenance revenues in the first half of 2022 it is mainly. For the specific contract 2 the company can expect 500 crore per year at full utilisation 1-2 years after commercialisation and 12-14 per cent EBITDA margins. After-tax Unadjusted Operating Margin.

Application of data-driven planning of production steps including drilling and blasting procedures and haul cycle times as. Management believes that EBITDA EBITDA per ton adjusted EBITDA adjusted EBITDA per ton free cash flow and on a segment basis adjusted gross margin adjusted gross margin as a percent of net. To know if an EBITDA multiple is good you must look at it compared to other similar types of businesses.

What really distinguished the 200607 time frame was that the deals were significantly larger both in absolute terms and relative to the rest of the market. It seeks to invest between 10M to 500M per transaction in companies with EBITDA between 5M and 150M sales value between 25M and 500M and enterprise value between 5M and 1000M. The justified PS ratio is calculated as the price-to-sales ratio based on the Gordon Growth Model.

On top of that its dividend yield is an. This is a low-margin 4-6 business as they are selling services for third parties. 1 day agoGroup EBITDA was almost flat 04 at EUR227m.

FORT WAYNE Ind July 20 2022 Second Quarter 2022 Performance Highlights. June 2021 Q Quarters ended June 30 2022. Typical borrowers have a minimum revenue and EBITDA of 50 million and 10 million respectively.

After-tax Lease RD adj Margin. On the trailing twelve months basis Ebitda Margin in 2 Q 2022 grew to 148. PE Ratio TTM is the Price Earnings ratio calculated by dividing the current Price by the Earnings.

Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. Pre-tax Lease RD adj Margin. Net Profit Margin Formula.

Based on 12 Wall Street analysts offering 12 month price targets for Broadcom in the last 3 months. The typical profit margin ratio of a company can be different depending on which industry the company is in. Net Profit margin Net Profit Total revenue x 100.

As a financial analyst this is important in day-to-day financial analysis. The average price target is 67636 with a high forecast of 77500 and a low forecast of 62000The average price target represents a 2947 change from the last price of 52240. The adjusted EBITDA margin fell from 118 to 93.

Pre-tax Unadjusted Operating Margin. Enhancement of product mixes and customer contracts to maximize the margin based on the trade-off between incremental products and associated value-chain costs. See My Options Sign Up.

Record steel fabrication operating income of 599 million and record shipments of 218000 tons. Quarter Ending June 30 2022 Highlights June 2022 Q vs. This is a measure of profitability.

Within Capital Goods sector 3 other. After-tax Lease Adjusted Margin. However automotive FCF in 2021 was supported by 75 billion in Ford Credit distributions which was more than double the typical level of recent years.

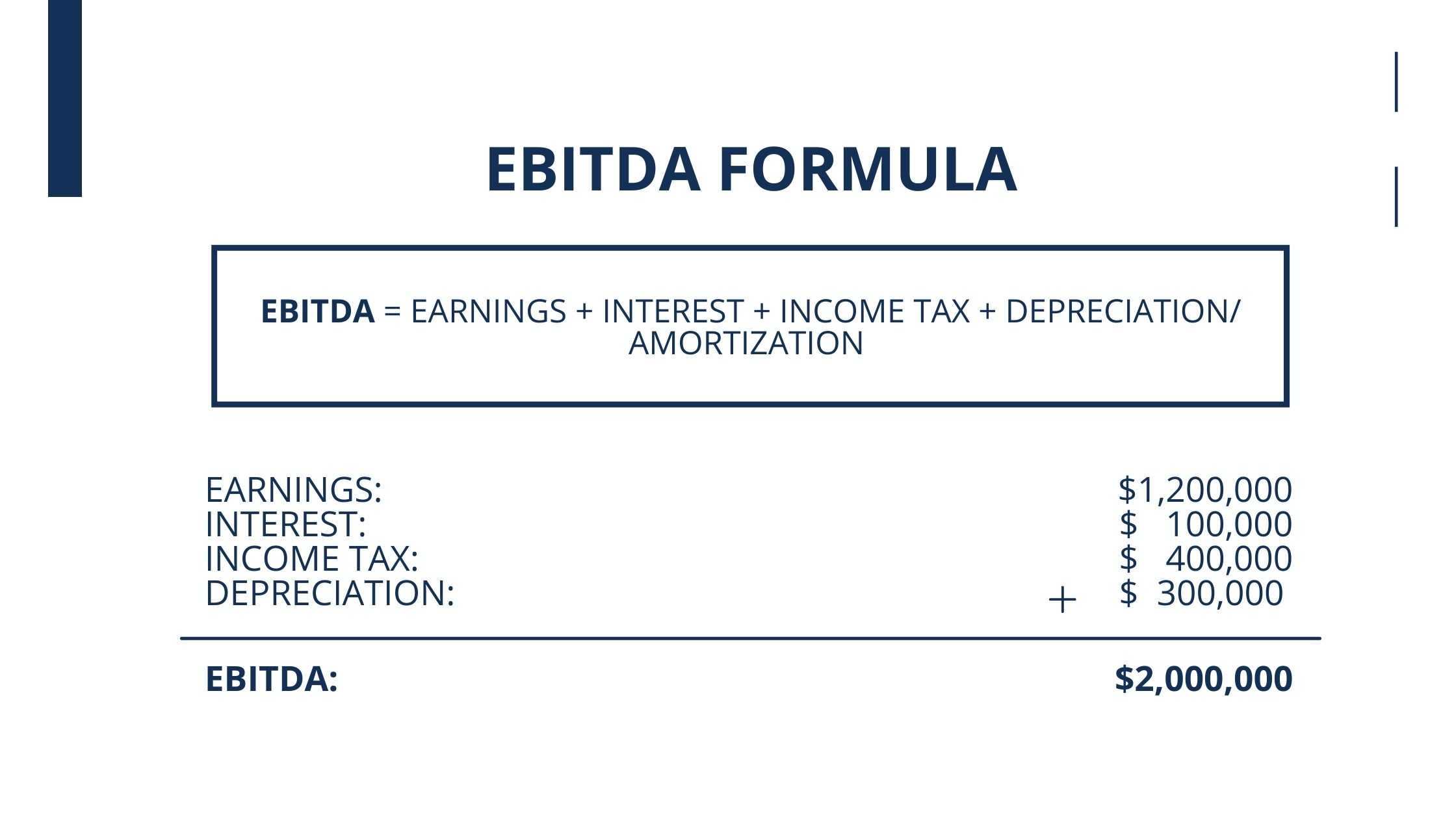

It has operated a relatively stable business with single-digit revenue growth and annual EBITDA margin increases of over 20 in the past five years. Adjusted EBITDA Earnings Before Interest Taxes Depreciation and Amortization is a measure computed for a company that looks at its top line earnings before deducting interest expense taxes. Selling writing a put option allows an investor to potentially own the underlying security at both a future date and a more favorable price.

Actual automotive FCF based on Fitchs methodology in 2021 was 31 billion when excluding 19 billion in cash costs associated with the redesign equivalent to a 25 FCF margin. Our diverse portfolio spans 100 relationships and includes cash flow real estate and asset-based loans ranging from 15 to 250 million. Among the top 10 P2P deals in those years not one was below 24 billion.

Record cash flow from. Pre-tax Lease adjusted Margin. This lets us find the most appropriate writer for any type of assignment.

Or equivalently divide the per-share stock price by the per-share revenue. Record net sales of 62 billion. Peloton will restrict its formal revenue gross margin adjusted EBITDA and net subscriber addition guidance to the current quarter for at least the duration of the next fiscal.

For example an average EBITDAsales margin for the advertising industry is 1739 meaning that EBITDA is 1739 of sales. CFI Financial Analysis Fundamentals Course. But unlikely to be above the typical 8-10 industry.

Record steel shipments of 31 million tons. A higher EBITDAsales multiple than average means a company is more profitable. Record operating income of 16 billion and net income of 12 billion.

Pricesales ratio PS ratio or PSR is a valuation metric for stocksIt is calculated by dividing the companys market capitalization by the revenue in the most recent year. In 2021 P2P multiples were 193 times EVEBITDA or 16 times the average.

Top 20 Professional Services Businesses Ebitda Margins 2016 Channele2e Technology News For Msps Channel Partnerschannele2e Technology News For Msps Channel Partners

Your Ebitda Margin Guide How To Use The Controversy Real Examples

Ebitda Margin Formula And Calculator Excel Template

Ranking America S Industries By Profitability And Tax Rate Financial Times

Ebitda Margin And Teu Throughput For A Selection Of Container Terminal Download Scientific Diagram

2016 Ebitda Margin As Percentage Of Revenue Selected Turbine Download Scientific Diagram

Ebitda Margin Formula And Calculator Excel Template

Rule Of 40 Susquehanna Growth Equity Sge

Ranking America S Industries By Profitability And Tax Rate Financial Times

Ebitda Margin Ultimate Guide

Ranking America S Industries By Profitability And Tax Rate Financial Times

Ranking America S Industries By Profitability And Tax Rate Financial Times

How Do I Calculate An Ebitda Margin Using Excel

What Is The Definition Of Ebitda Margin

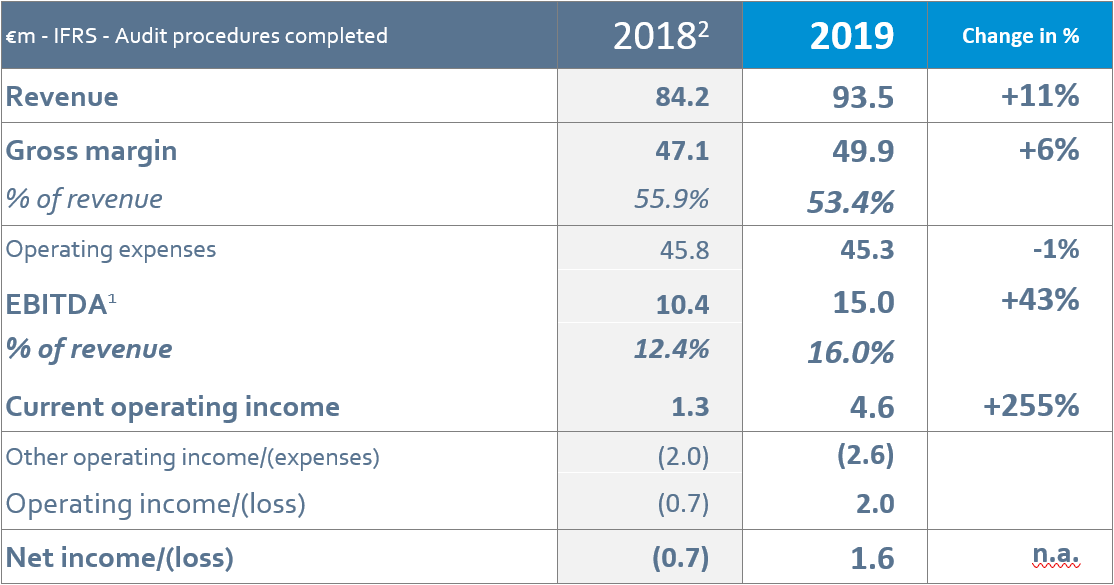

2019 Annual Results Revenue 11 Ebitda 43 Record Ebitda Margin Of 16 0

Ranking America S Industries By Profitability And Tax Rate Financial Times

Energy Equipment And Services Ebitda Margin Growth 2020 Statista