Stock gains calculator

Ad Build Your Future With a Firm that has 85 Years of Investment Experience. Must be a valid email address.

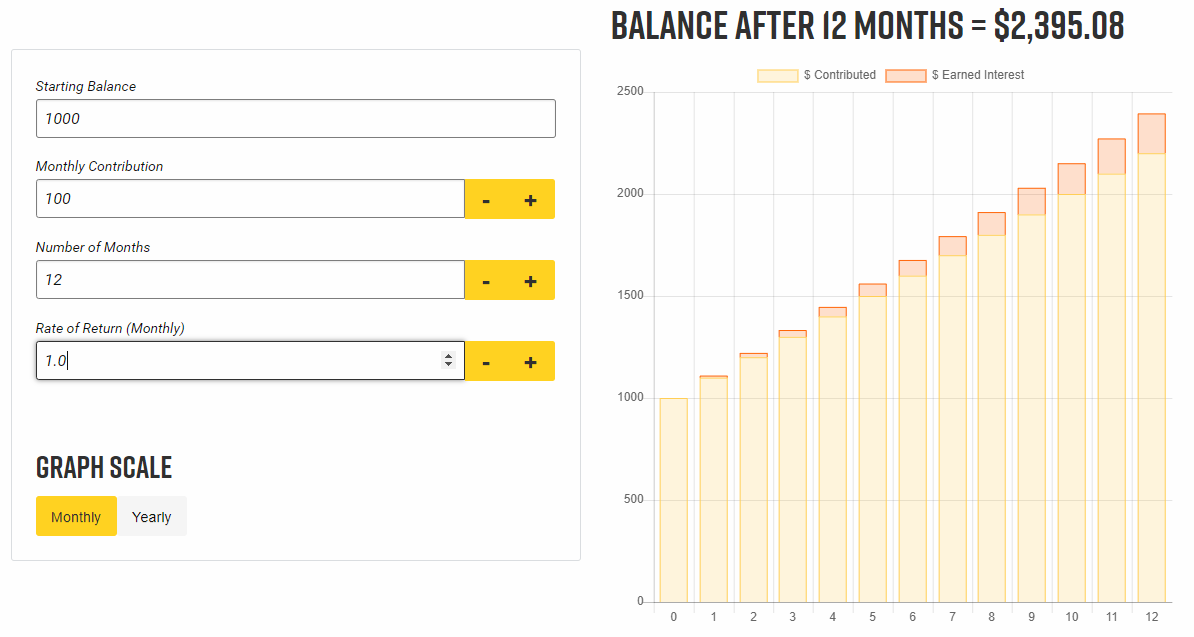

Compounding Gains Calculator Tackle Trading

2021 capital gains tax calculator.

. Find the best spreads and short options Our Option. Using this calculator is quite easy you are required to enter the following. Net Gain or Net Loss Current Price - Original Purchase Price Original Purchase Price x 100.

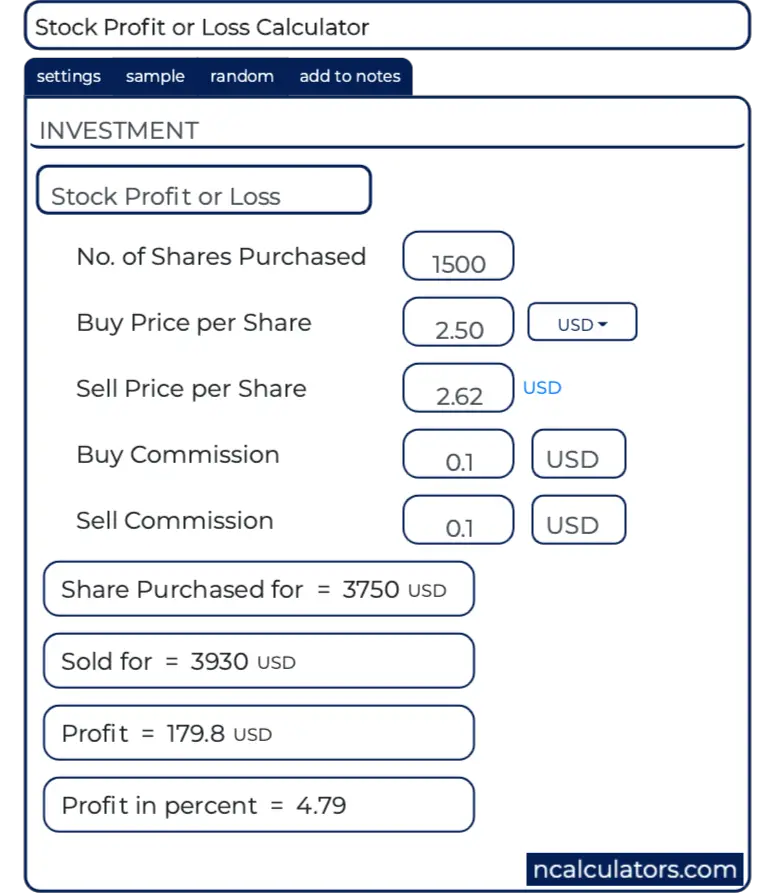

Ad An easy way to get started with online trading. Stock Profit Calculator is the best calculator to calculate net profits after the commissions you incur for buying and selling for your return on investment. Capital Gains Tax Calculator.

Forbes Advisors capital gains tax calculator helps estimate the taxes youll pay on profits or losses on sale of assets such as real estate stocks bonds. Tackle 25 MasterMind Group. Two main ways to profit from a.

Ad An easy way to get started with online trading. When stock market prices took a dive at the beginning of COVID-19 millions of people jumped into the stock market to take advantage of the low prices and millions also sold. Bear Market Survival Guide MasterMind Group.

2022 capital gains tax rates. Capital Gain Tax Calculator for FY19. The average adjusted cost basis per share is 25.

Hard 14 MasterMind Group. Add multiple results to a. Password must be 8-64 characters.

To help such investors we have designed this stock profitloss calculator that gives you accurate results in seconds. Poor Mans Covered Call calculator addedPMCC Calculator. Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

A calculator to quickly and easily determine the profit or loss from a sale on shares of stock. Calculate what you may owe with Personal Capitals capital gains tax calculator. Finds the target price for a desired profit amount or percentage.

While if you hold that property or stock. Cash Flow Condors MasterMind Group. Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

Multiply that figure by 100 to get the percentage change. Investments can be taxed at either long term. Must be a valid phone.

The same property or stock if sold within a year will be taxed at your marginal tax rate as ordinary income. Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

Use this tool to calculate applicable capital gain tax on your investment sold in financial year FY18-19. Short-term and long-term capital gains tax. For example if you buy 100 shares at 20 and later buy another 100 shares at 30 your total cost basis is 5000 100 20 100 30.

Cash Secured Put calculator addedCSP Calculator.

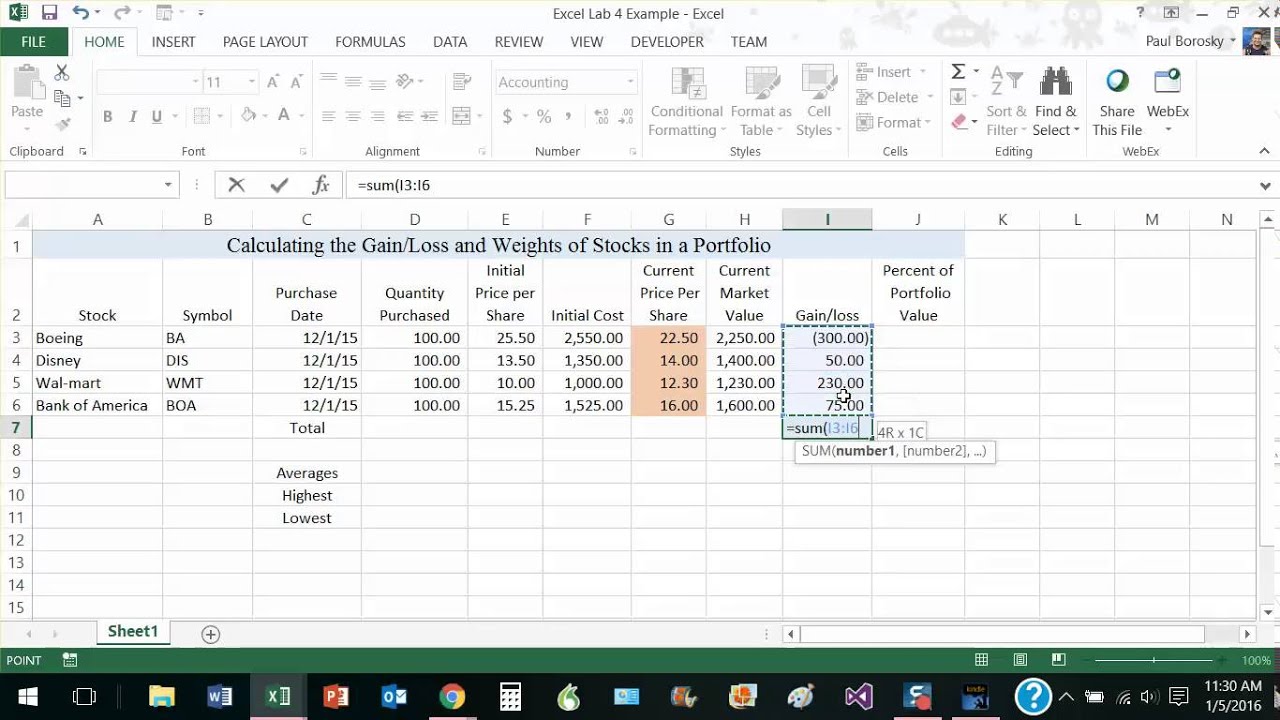

Common Stock Formula Calculator Examples With Excel Template

Uk Hmrc Capital Gains Tax Calculator Timetotrade

Stock Profit Or Loss Calculator

Using Excel To Calculate Gain Or Loss And Weight Of Stocks In A Portfolio By Paul Borosky Mba Youtube

Stock Profit Calculator Salecalc Com

Common Stock Formula Calculator Examples With Excel Template

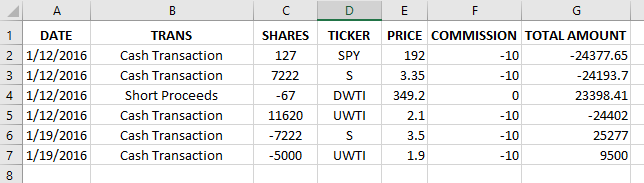

Using Spreadsheets Calculating Profit Or Loss From Trades Personal Finance Lab

Long Term Capital Gain Tax On Share And Mutual Fund Excel Calculation To Find Ltcg Of Mutual Fund Youtube

Capital Gain Formula Calculator Examples With Excel Template

Stock Calculator

Capital Gains Yield Cgy Formula Calculation Example And Guide

How To Calculate Long Term Capital Gains Tax Capitalmind Better Investing

Common Stock Formula Calculator Examples With Excel Template

Capital Gains Tax On Property Sale A Calculator Unovest

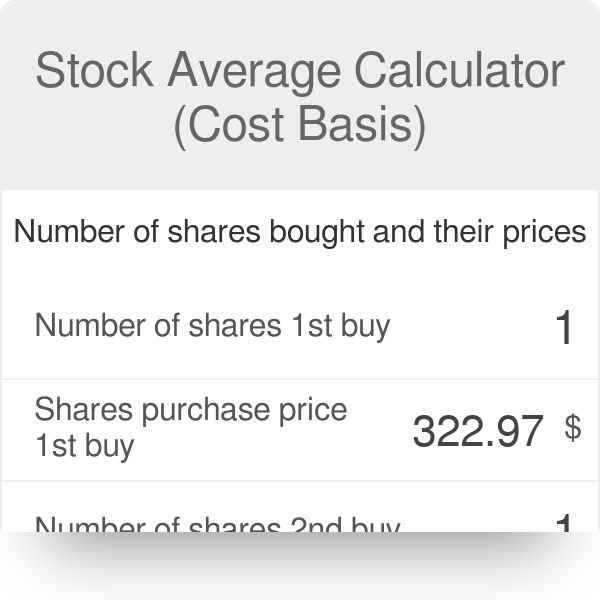

Stock Average Calculator Cost Basis

How To Calculate Stock Profit Sofi

Capital Gain Formula Calculator Examples With Excel Template